-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Key Takeaways:

*U.S. equities surged to fresh record highs amid easing Middle East tensions, improving U.S.-China trade sentiment, and renewed yen carry trade momentum boosting global liquidity.

*Markets eye the Trump–Xi meeting in Korea, expected to ease trade frictions and lift tech sentiment, particularly around rare earth mineral export restrictions.

*Investors brace for the Fed’s 25 bps rate cut and a wave of “Magnificent Seven” earnings — with Microsoft, Alphabet, and Meta reporting today, followed by Apple and Amazon tomorrow.

Market Summary:

Wall Street extended its rally overnight, buoyed by a broad risk-on sentiment that continues to drive U.S. equities toward fresh all-time highs. Market optimism has been fueled by several tailwinds, including the easing of Middle East geopolitical tensions, signs of progress in U.S.-China trade relations, and renewed enthusiasm around the yen carry trade, which has helped bolster global liquidity.

Investors are now turning their attention to a pivotal meeting between U.S. President Donald Trump and Chinese President Xi Jinping at the APEC summit in Korea tomorrow. Markets widely expect the talks to further defuse trade frictions and potentially ease export restrictions on rare earth minerals — a key component for the technology sector — which could lend additional upside momentum to the Nasdaq and other major indices.

Adding to the bullish backdrop, artificial intelligence (AI) optimism remains a dominant force propelling equity valuations higher. The focus this week also shifts to the earnings season for the so-called “Magnificent Seven” tech giants, which could dictate short-term price action. Microsoft, Alphabet, and Meta Platforms are set to report results later today, while Apple and Amazon will follow tomorrow.

Meanwhile, the Federal Reserve’s rate decision later today remains another key event risk for investors, as markets fully price in a 25-basis-point cut. Any deviation in tone or forward guidance from Fed Chair Jerome Powell could trigger heightened volatility across risk assets.

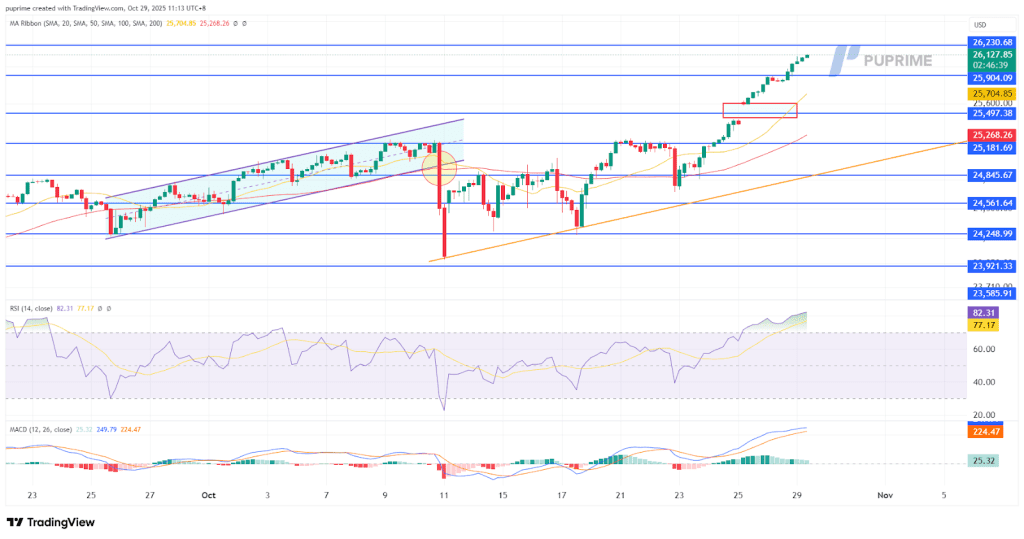

The Nasdaq continued to trade with strong upside momentum this week, advancing nearly 3% and reinforcing a bullish bias for the tech-heavy index. However, recent price action suggests that the upward momentum is beginning to moderate, with the index now approaching a key resistance level near the 26,230 mark. A pause or technical pullback could occur at this threshold, though a decisive break above it would signal renewed strength and potentially open the door to further gains.

Technical indicators remain supportive of the broader uptrend. The Relative Strength Index (RSI) continues to hover in overbought territory, underscoring strong buying pressure, while the Moving Average Convergence Divergence (MACD) line is still trending higher — suggesting that bullish momentum remains intact and may propel the index toward fresh record highs if resistance is breached.

Resistance Levels: 26,230.00, 26,625.00

Support Levels: 25,910.00, 25,525.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!