PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

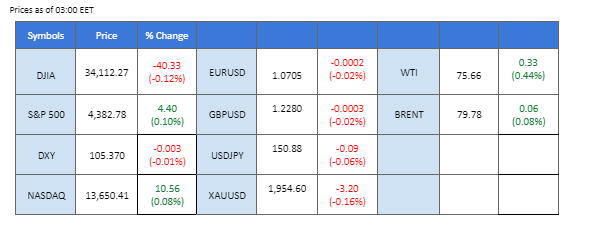

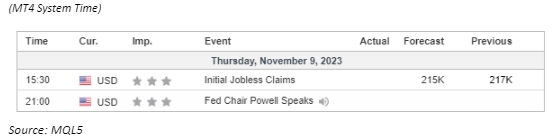

The VIX index, a key measure of fear in the U.S. equity market, plummeted by over 20% in November, indicating a rising risk-on sentiment among investors. However, market activity remained subdued recently as investors eagerly anticipated Jerome Powell’s speech scheduled for later today. Against the backdrop of declining U.S. long-term treasury yields, market participants are keenly seeking hints about the Federal Reserve’s future monetary policy decisions. Oil prices continued to experience downward pressure due to deteriorating demand from China coupled while oil supplies remain ample. Conversely, Bitcoin (BTC) prices surged to $36,000, reaching levels not seen since May, driven by optimistic expectations regarding the approval of a Spot BTC ETF application by the Securities and Exchange Commission (SEC).

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.0%) VS 25 bps (10%)

The US Dollar is in a consolidation phase as markets eagerly await Fed Chair Jerome Powell’s statement. Following a significant selloff last week, the Greenback’s appeal remains weak. Many economists anticipate a slowdown in the US economy for the fourth quarter, dampening hopes for further Fed rate hikes. Powell refrained from commenting on monetary policy in his recent speech, leaving investors on edge for any forthcoming signals from the Federal Reserve.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 46, suggesting the index might extend its losses after its breakout below the support level since the RSI stays below the midline.

Resistance level: 106.10, 106.75

Support level: 105.40, 104.80

Gold prices continue to slide as a prevailing risk-on sentiment dominates global financial markets. Hopes for improved US-China relations have shifted sentiment toward higher-risk assets. Anticipation of a key meeting between US President Joe Biden and Chinese leader Xi Jinping at the Asia-Pacific Economic Cooperation summit in San Francisco has fostered optimism. Recent high-level meetings between the two nations have sent positive signals to the world.

Gold is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 24, suggesting the commodity might enter oversold territory.

Resistance level: 1960.00, 1980.00

Support level: 1940.00, 1915.00

The strength of the U.S. dollar decreased yesterday in anticipation of Jerome Powell’s much-awaited speech scheduled for later today. Investors worldwide are hanging on his word, hoping to glean insights into the Federal Reserve’s upcoming monetary policy decisions. In Europe, Germany’s Consumer Price Index (CPI), disclosed yesterday, aligned perfectly with market forecasts. The CPI figure stood at an elevated level, leading market analysts to speculate on a potential rate hike from the European Central Bank (ECB). Eyes are now turned to the ECB’s chair, who is anticipated to address this topic in her speech later today.

EUR/USD trades rebounded yesterday on the softening dollar and remain within its uptrend channel. The RSI is flowing in an elevated region while the MACD has signs of crossing above the zero line, suggesting a bullish momentum might be forming.

Resistance level: 1.0775, 1.0866

Support level: 1.0630, 1.0560

The British Pound faced a setback, unable to maintain its stronghold above the crucial support level of 1.2300. It trades below this threshold, signalling a potential shift from its bullish trajectory. A respite for the Sterling came as U.S. Treasury yields dipped below 4.5% yesterday, easing some of the bearish pressure. Investor attention is now focused on the upcoming speech by the Federal Reserve’s chair, scheduled for later today. Simultaneously, the market is keeping a keen eye on the release of the UK’s Gross Domestic Product (GDP) data tomorrow. Both events are poised to be pivotal moments for Cable, shaping its direction amidst ongoing market volatility.

The Cable retraced sharply since Monday and is currently trading below its then-support level, suggesting a bearish signal for Cable. The RSI flowed flat while the MACD eased from declining, suggesting the bearish momentum is eased.

Resistance level: 1.2300, 1.2410

Support level: 1.2060, 1.1830

The US equity market continues its bullish run, although the pace has slowed. Investors are eagerly anticipating a clearer monetary policy statement from the Federal Reserve. This follows a notable retreat in US Treasury yields since late October when the 10-year Treasury yields touched 5%. The expectation that the central bank may be nearing the end of its rate-hike cycle gained momentum, fueled by comments from several Fed officials and softer labour data.

The Dow is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 34560.00, 35465.00

Support level: 33780.00, 32705.00

The Swiss Franc has exhibited resilience against the dollar at the beginning of November, even as the dollar staged a comeback, hampering the Franc’s momentum. Notably, the U.S. made a significant move by removing Switzerland from its list of monitored countries, relieving it from allegations of currency manipulation. The Swiss National Bank (SNB) engaged in substantial foreign currency purchases to counter the appreciation of safe-haven currency. However, the U.S. action might pose a challenge for the SNB, potentially restricting its ability to influence the valuation of the Swiss Franc. This development could further strengthen the Swiss Franc in the currency market.

The pair experienced a technical rebound, but it is still kept below the Fibonacci 61.8% level, suggesting the bearish momentum is still intact. RSI hovering flat while the MACD is flowing below the zero line, suggesting the bearish momentum is still intact with the pair.

Resistance level: 0.9070, 0.9120

Support level: 0.8900, 0.8827

Oil prices have endured a second consecutive day of losses, sinking to four-month lows. This downturn is driven by a gloomy global economic outlook, with major nations like the US, UK, EU, and China contributing to a decreased appetite for oil. Delays in the release of weekly US inventory data by the Energy Information Administration, as they rework their data methodology, have added to the uncertainty. As the meantime, investors are digesting the American Petroleum Institute’s inventory data, which revealed a staggering increase of nearly 12 million barrels, vastly exceeding expectations of 300,000 barrels

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the commodity might enter oversold territory.

Resistance level: 78.15, 80.75

Support level: 73.35, 69.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!