-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Are you ready to explore a game-changing tool in CFD trading that could redefine your risk management strategy? Trade loss vouchers are becoming a vital tool for traders, especially for beginners, in the fast-paced CFD trading world. They introduce a fresh way to handle possible trading losses and offer chances for smart trading.

We’re going to look into CFD trading and the idea behind trade loss vouchers. This guide will show how these tools can improve your trading game and act as a safety net for new market entrants. We will go from the basics to more advanced tips. You will learn how to use trade loss vouchers in your CFD trading adventure.

As we explore the world of CFD trading and managing risks, we will look at what the experts say and industry data. For instance, did you know retail Forex traders often use leverage due to limited capital? Also, the spread on top currency pairs can be tiny, less than a pip. These points highlight the need for tools like trade loss vouchers for clever risk management in today’s market.

* Trade Loss Vouchers (TLVs) are crucial tools for managing risk in CFD trading.

* TLVs act as a safety net, particularly beneficial for new traders navigating the volatility of financial markets.

* Benefits of TLVs include reducing potential losses by reimbursing a portion of losses incurred during trading.

* Drawbacks may involve overreliance

* Limited time offer during exclusive sports seasons to attract traders looking for enhanced risk management options.

CFD trading has become more popular lately. CFD means Contract For Difference. It lets traders guess on price movements without having the asset. A CFD broker helps make these trades using a CFD trading platform.

You bet on if an asset’s price will go up or down when trading CFDs. This means you can make money in good or bad markets. CFDs are available for various things like stocks, commodities, and currencies. You can find them all in one place on your platform.

Leverage is a big part of CFD trading. It allows you to manage a big trade with a small amount of money. But, if the market goes the wrong way, losses can be big. So, knowing the risks is very important.

Learn What You Need To Trade CFD

Start Reading

Trade loss vouchers are like a safety net for traders on CFD trading platforms. They help recover some losses under certain conditions. These are very helpful, especially for new traders.

CFD brokers give these vouchers as part of special offers or loyalty programs. They aim to shield traders from large trading losses. This is key for those starting in CFD trading.

In PU Prime, our Trade Loss Voucher offers a unique approach to managing trading losses. A Trade Loss Voucher helps you to offset a portion of your trading losses and get back some of your lost amount once the coupon has been applied. This also serves as an encouragement for continued participation in trading activities despite occasional losses.

PU Prime Trade Loss Vouchers provide beginners with a valuable risk management tool, allowing them to mitigate potential losses effectively. By using these vouchers, beginners can:

1. Reduce Risk Exposure: Vouchers enable beginners to limit losses on specific trades, offering a safety net during their early trading experiences.

2. Learn Without Fear: Beginners can experiment with trading strategies and learn from mistakes without the fear of significant financial setbacks, as the vouchers help offset losses.

3. Build Confidence: By using Trade Loss Vouchers, beginners can build confidence in their trading decisions, knowing they have a tool to manage unforeseen losses.

4. Enhance Learning: Each voucher usage presents a learning opportunity, as beginners can analyze their trading performance and make informed adjustments for future trades.

5. Promote Responsible Trading: Encourages beginners to adopt responsible trading practices by incorporating risk management tools from the outset of their trading journey.

6. Immediate Risk Management: The vouchers provide an immediate means to manage losses, ensuring beginners can focus on their trading strategies and market analysis without undue concern over potential downturns.

These benefits collectively support beginners in developing their trading skills while safeguarding their initial investments, fostering a more informed and confident approach to trading with PU Prime.

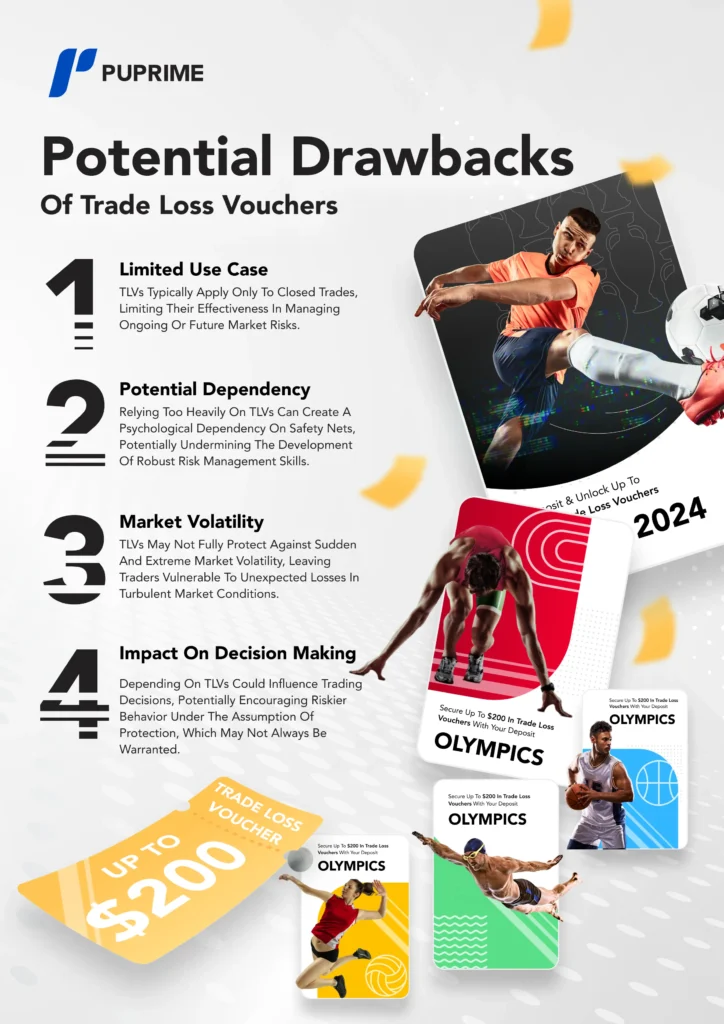

While Trade Loss Vouchers (TLVs) offer several benefits, there are also potential drawbacks and considerations to keep in mind, where investors should be aware of:

1. Limited Use Case: TLVs typically apply only to closed trades, limiting their effectiveness in managing ongoing or future market risks.

2. Potential Dependency: Relying too heavily on TLVs can create a psychological dependency on safety nets, potentially undermining the development of robust risk management skills.

3. Market Volatility: TLVs may not fully protect against sudden and extreme market volatility, leaving traders vulnerable to unexpected losses in turbulent market conditions.

4. Impact on Decision Making: Depending on TLVs could influence trading decisions, potentially encouraging riskier behavior under the assumption of protection, which may not always be warranted.

These considerations highlight the importance of using TLVs judiciously within a comprehensive risk management strategy, ensuring they complement rather than substitute effective trading practices.

Trade loss vouchers are key for new CFD traders. They provide a safety net, easing beginners into trading. With these vouchers, new traders can learn without worrying about big losses.

Platforms like PU Prime give these vouchers to help their traders succeed. But, it’s important to use them with a solid strategy. This should also include managing risks well and always learning more.

Vouchers are good but not the only thing to rely on. To do well in CFD trading, it takes more. It needs smart use of vouchers, deep market study, and staying disciplined with your trades.

Open A Live Account With PU Prime And Start Trading

Join Now

CFD stands for Contract for Difference, a derivative financial instrument that allows traders to speculate on the price movements of various assets without owning the underlying asset itself. Traders can profit from both rising and falling markets by entering into contracts with a CFD broker, using platforms designed for CFD trading.

Trade Loss Vouchers are risk management tools provided by CFD brokers like PU Prime. These vouchers help traders mitigate losses by offsetting a portion of their trading losses under specific conditions. TLVs encourage responsible trading practices and provide a safety net for traders, especially beginners, allowing them to manage risk effectively.

Beginners in CFD trading can benefit from TLVs in several ways. TLVs reduce risk exposure by limiting losses on specific trades, thereby building confidence and allowing for experimentation with trading strategies without the fear of significant financial setbacks. They also promote responsible trading habits and immediate risk management.

While TLVs offer significant benefits, traders should be aware of their limitations. TLVs typically apply only to closed trades, which may restrict their effectiveness in managing ongoing market risks. There’s also a risk of developing dependency on TLVs, potentially influencing trading decisions and encouraging riskier behavior under the assumption of protection.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!