-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Topic Summary:

Treasury bills, notes, and bonds reveal how interest rate expectations shift across different time horizons, and their yields often influence currencies, equities, and commodities.

By watching these moves and the shape of the yield curve, traders can get a clearer sense of market sentiment.

Treasury bills (T-bills), notes, and bonds may seem simple enough on the surface, but they carry a lot of information about where the market thinks interest rates and growth are heading.

Investors treat them as safe sources of income.

Traders follow them for clues about short and medium-term price trends in other markets.

Learning how these securities behave helps you read the yield curve and understand changes in USD strength, equity movements, and commodity pricing.

Treasury securities come in three main types: T-bills, notes and bonds.

The difference is how long it takes them to mature and how they pay interest.

Traders observe each other because they react differently to changes in interest rates and economic conditions.

| Feature | T Bills | T Notes | T Bonds |

| Maturity | 4 to 52 weeks | 2 to 10 years | 20 or 30 years |

| Interest Payments | None, sold at a discount | Fixed interest, paid twice a year | Fixed interest, paid twice a year |

| How You Earn | Buy at a discount, get face value at maturity | Receive semiannual coupons plus principal | Receive semiannual coupons plus principal |

| Main Market Driver | Low sensitivity to long-term moves | Growth and inflation outlook | Short-term Fed rate expectations |

| Price Sensitivity | High sensitivity to long-term rate changes | Moderate sensitivity | Read short-term rate shifts |

| Common Use for Traders | Track mid-term yield direction | Watch long-term risk sentiment | Watch long term risk sentiment |

Each type of Treasury responds to a different part of the economic cycle, so traders use them to understand how expectations are shifting in real time.

Together, they give a clearer picture of market sentiment and potential movements across other asset classes.

If you want to explore how different bond types compare more broadly, you can read PU Prime’s guide.

Treasury yields move throughout the trading day, making them a reliable gauge of how the market is thinking about interest rates and the economy.

Even small shifts can signal changes in risk appetite, policy expectations, or growth forecasts.

Traders watch different maturities because each one highlights a different time horizon.

Short-term yields often move first.

T-bills react quickly to expectations for upcoming Federal Reserve decisions, helping traders understand near-term interest rate sentiment.

Medium-term yields come next.

T notes respond to changes in growth and inflation expectations, making the 10-year note one of the most closely followed instruments in global markets.

Long-term yields move more slowly but carry essential information about long-range confidence and inflation stability.

When T-bonds shift, it can signal how comfortable the market is with the long-term outlook.

Treasury yields influence many other markets because they reflect expectations for interest rates, financial conditions, and overall confidence.

When yields move, traders often see a response in currencies, equities, and commodities, which helps build a clearer picture of where sentiment is heading.

In Forex, higher Treasury yields can support the US dollar because they improve the return on USD assets.

When yields fall, the dollar may lose some of that support, especially if the market anticipates rate cuts.

Equity markets react differently.

Rising yields can pressure stock indices as borrowing costs increase and investors become more cautious.

Falling yields can ease those concerns and, at times, support stronger equity performance.

Commodities also feel the impact.

Gold is sensitive to yield movements because it does not generate interest, so rising yields can reduce its appeal, while lower yields can make it more attractive.

Oil may shift as well, since yield changes often reflect expectations for future economic growth.

These connections help traders understand how different parts of the market are responding to the same economic signals.

A change in Treasury yields can be an early sign of a broader shift that later appears across multiple asset classes.

The yield curve shows how Treasury yields change across different maturities, and it gives traders a simple way to see how expectations are shifting across the economy.

Instead of looking at each maturity on its own, the curve brings everything together so you can read short, medium, and long-term views in one place.

Short-term yields usually reflect near-term policy expectations.

Longer maturities tend to capture views on growth and inflation.

When you compare these points side by side, the curve becomes a quick way to gauge the market’s confidence or caution.

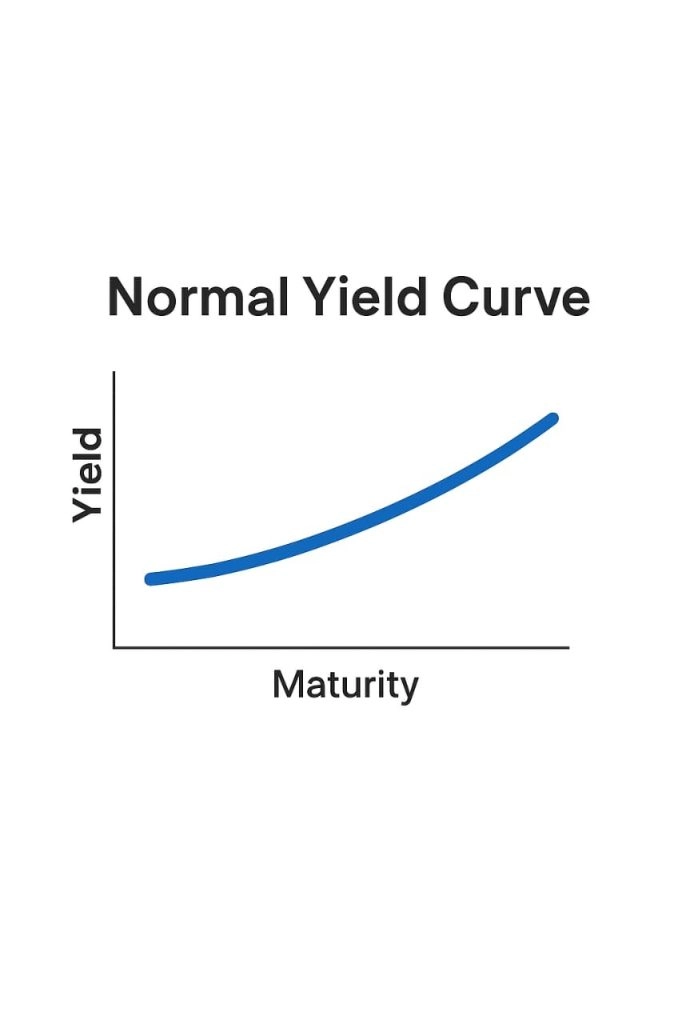

A normal curve slopes upward because long-term yields sit above short-term yields.

This often suggests steady economic conditions.

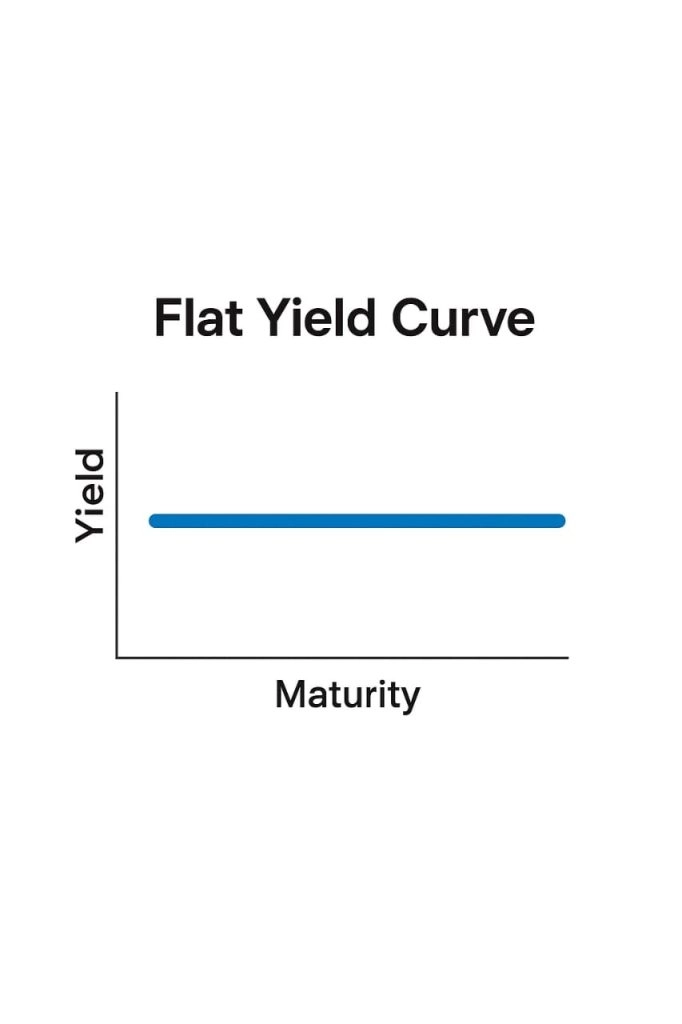

A flat curve appears when yields across different maturities sit close together, which can show uncertainty about the outlook.

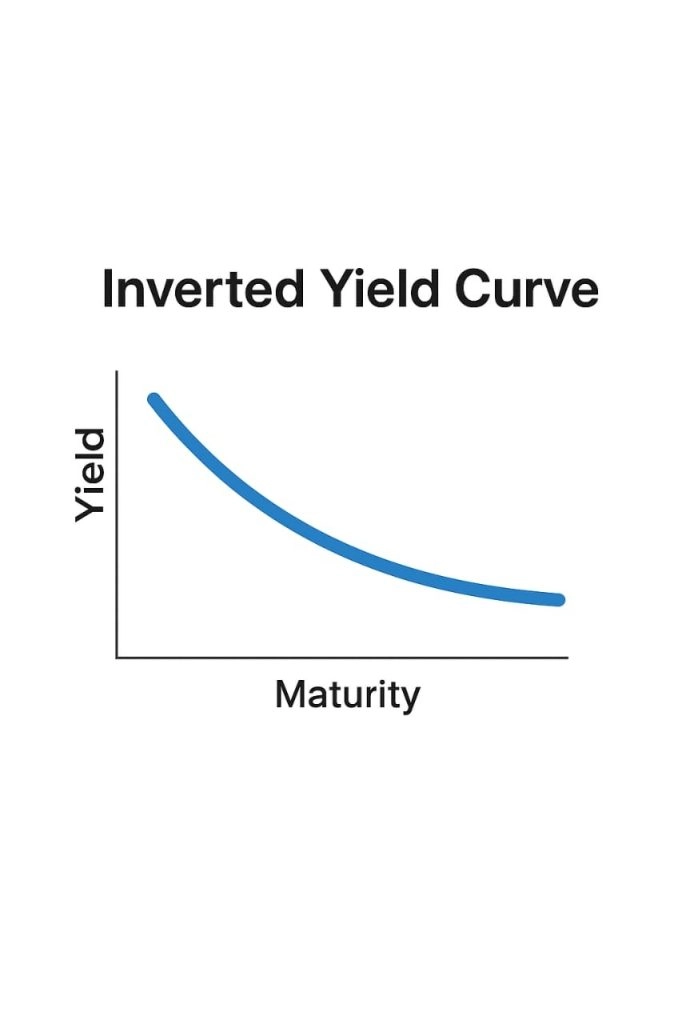

An inverted curve occurs when short-term yields exceed long-term yields.

This signal is watched closely because it often appears when the market expects softer conditions ahead.

Changes in the curve can reveal shifts in expectations before they show up in other markets.

A steepening curve can point to stronger growth expectations.

A flattening curve can suggest that traders are becoming more cautious.

If the curve inverts, it can indicate that the market is preparing for slower momentum.

These shifts often influence positioning across currencies, stocks, and commodities by helping traders build a clearer view of where sentiment is heading.

Beyond the broad categories of bills, notes, and bonds, a few specific maturities tend to attract most of the market’s attention.

These benchmarks shape sentiment, influence pricing models, and often guide how traders use Treasury-based CFDs on platforms such as PU Prime.

Short-term T bills, such as the 3-month and 6-month maturities, give a quick read on expectations for upcoming Federal Reserve decisions, because their yields closely track short-term interest rate pricing.

When these yields move, they can highlight shifts in how traders see the path of policy over the next few meetings.

Active traders often keep an eye on these benchmarks around key data releases and Fed announcements.

The 2-year note is closely linked to interest rate expectations over the next couple of years.

Its yield is widely treated as a policy proxy because it reacts quickly to changes in the federal funds rate outlook and Fed communication.

Sudden moves in the 2-year yield can suggest that the market is reassessing the likely path of policy, which can feed into positioning across forex, equity indices, and rate-sensitive sectors.

The 10-year note sits near the center of the yield curve and blends growth and inflation expectations.

It is a core benchmark for many long-term borrowing costs, including U.S. mortgage rates, and it often feeds into valuation models for equities and corporate debt.

Changes in the 10-year yield can influence how investors value future cash flows and affect stock indices and sector performance.

The 30-year bond reflects expectations for economic conditions and inflation far into the future.

Moves at this long end of the curve are often linked to long-range inflation expectations, government borrowing needs, and demand from pensions and insurers that focus on very long-term liabilities.

Traders may watch the 30-year yield together with shorter maturities to see whether confidence in the long-term outlook is holding up or starting to fade.

Many traders track these benchmarks side by side and use Treasury-based CFDs on PU Prime to respond when yields start to shift, taking long or short positions as sentiment evolves across global markets.

Investors and traders approach Treasuries with very different goals.

That difference shapes how they read price movements, respond to economic data, and choose the tools they use to trade.

Investors see Treasuries as a reliable place to store capital.

They care about steady coupon payments and the comfort of knowing the principal will be returned at maturity.

Because they plan to hold these securities for long periods, day-to-day yield changes rarely shift their plans.

Their focus is long-term stability, not short-term movement.

Traders view Treasuries through a very different lens.

They track yield changes, monitor how markets react to economic reports, and look for points where sentiment shifts.

When yields rise or fall, prices move in the opposite direction, and that is where traders focus.

Shorter time horizons shape their decisions, so they respond quickly when expectations for interest rates shift.

Owning a Treasury security directly is a slow-and-steady approach, which is why it appeals to long-term investors. Traders usually need more flexibility.

They often use futures, options, or CFDs because these tools allow them to react more quickly and adjust positions without holding the underlying bond.

Treasury-based CFDs on PU Prime, for example, follow the price of the underlying instrument, so traders can take long or short positions without taking ownership.

Remember: trading derivatives is speculative and can lead to losses, and you do not own the underlying security when using CFDs.

Traders have several ways to take positions on Treasury price movements, and each approach offers a different level of flexibility.

Unlike long-term investors who usually buy and hold the actual securities, traders look for tools that let them respond quickly when yields shift or sentiment changes.

Treasury futures are one of the most widely used ways to trade these markets.

The contracts track specific Treasury maturities, helping traders follow short-, medium-, and long-term movements.

Futures are standardized, liquid, and built for fast execution, which makes them a familiar option for active traders.

Options on Treasury futures offer another layer of control, since they give the right, but not the obligation, to buy or sell a futures contract at a set price.

Traders often use them when they want exposure to potential price movement while limiting the amount they commit upfront.

The payoff can vary depending on how yields shift, so options tend to suit traders who want greater flexibility.

CFDs provide a different kind of access.

Instead of owning or entering into a contract tied directly to the bond, traders speculate on the bond’s price changes.

Treasury-based CFDs on PU Prime, for example, track the price of the underlying instrument, so traders can open long or short positions depending on how they expect yields to move.

Because CFDs are leveraged products, they offer flexibility, but they also carry risk.

Trading CFDs is speculative, and you do not own the underlying securities when using them.

These instruments allow traders to focus on short- and medium-term movements without committing to the long holding periods associated with direct ownership.

Each tool offers its own balance of speed, leverage, and control, allowing traders to adjust positions as market conditions evolve.

Treasury bills, notes, and bonds sit at the core of global markets, and they offer more than just stability for long-term investors.

Their yields respond to shifts in interest rate expectations, economic data, and broader market sentiment, which is why traders watch them so closely.

When you understand how each maturity reacts to different conditions, it becomes easier to read the signals that flow into currencies, equities, and commodities.

This connection makes Treasuries a valuable guide for anyone following short or medium-term market movements.

For traders who want flexible access to these price changes, Treasury-based CFDs on PU Prime allow them to follow the underlying price without owning the bonds.

Remember: CFD trading is speculative and carries risk, but it allows traders to react quickly as yields move and sentiment evolves across global markets.

Treasury prices move inversely to yields. When expectations for higher interest rates increase, prices usually fall. When expectations shift toward lower rates, prices tend to rise.

The 10-year note sits in the middle of the yield curve and captures both growth and inflation expectations. It influences many pricing models and is widely used as a benchmark across global markets.

Yes. Yields can move during overseas trading sessions as markets digest global economic news, policy statements, or risk events, and those moves often carry into the next trading day.

Shorter maturities can be more price-stable, but they react more quickly to policy expectations.

This means they may show sharp moves around major economic announcements.

Fed meetings, inflation data, employment reports, and GDP updates often create the most noticeable moves because they directly influence interest rate expectations.

CFDs track the underlying Treasury instrument, so their prices reflect movements in the corresponding futures or cash markets, depending on the product structure.

You do not own the bond when trading CFDs.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!